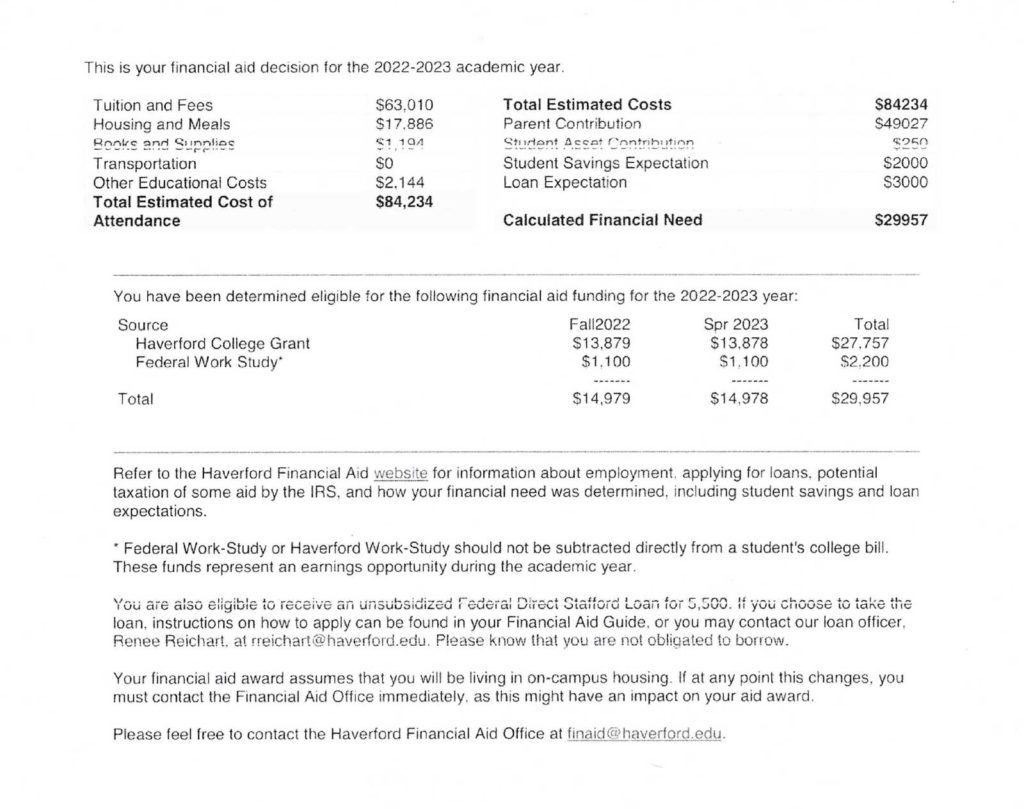

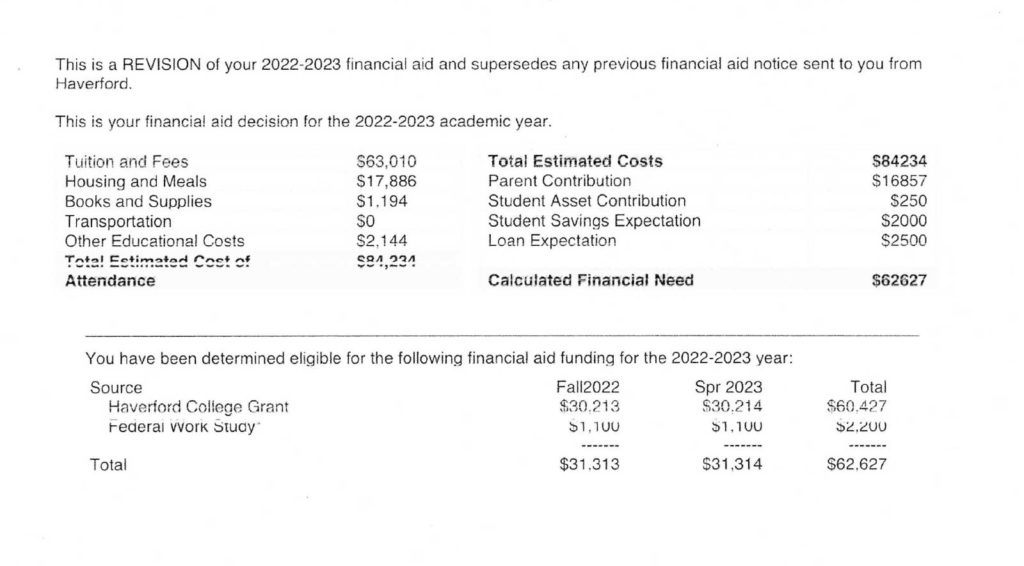

Navigating Financial Aid at the 20 Most Searched Colleges and Universities. Choosing a college is a significant decision, and understanding the financial aid options available can be just as crucial as selecting a major. With the rising cost of higher education, many students and their families are concerned about affordability and are completing the FAFSA and CSS Profile to help offset the expense.

As a financial aid consultant, I’ve noticed a trend in the most searched colleges and universities—an indication of where students are hoping to invest their futures. Here, we’ll dive into what interest in these schools could mean for students seeking financial aid and how partnering with a financial aid advisor could be your ticket to unlocking more funding opportunities.

1. University of California, Irvine (UCI)

UCI is known for its strong research programs and diverse student body. Financial aid here is comprehensive, offering scholarships, grants, and work-study opportunities.

2. University of California System (UCS)

The UCS encompasses several campuses, each with its own aid programs. Aid packages typically include federal, state, and institutional funds.

3. University of California, Santa Barbara (UCSB)

UCSB’s picturesque campus and robust academic offerings are attractive. Financial aid often includes merit-based scholarships for high-achieving students.

4. University of Central Florida (UCF)

UCF is one of the largest universities by enrollment. It provides a

variety of financial aid options, including the Pegasus Scholarship

program for incoming freshmen.

5. University of California, San Diego (UCSD)

UCSD’s financial aid office assists students through grants, loans, and scholarship resources, with an emphasis on supporting low-income students.

6. Houston Community College (HCC)

HCC offers an affordable entry into higher education, with financial aid options geared toward transfer students and those in certificate programs.

7. Louisiana State University (LSU)

LSU offers a variety of aid, including scholarships for residents, non-residents, and international students, as well as need-based options.

8. Washington University in St. Louis (WUG)

Known for its generous financial aid, WUG meets 100% of demonstrated need for admitted students, a significant draw for applicants.

9. University of California, Davis (UC Davis)

UC Davis is committed to sustainability and provides a range of financial aid options, including grants for students in the agricultural and environmental sciences.

10. University of California, Santa Cruz (UCSC)

UCSC’s financial aid includes the Blue and Gold Opportunity Plan, covering tuition for California residents whose families earn less than a set income threshold.

11. Harvard University

As an Ivy League institution, Harvard meets 100% of demonstrated financial need without loans, making it more accessible than many assume.

12. Kennesaw State University (KSU)

KSU offers financial aid to a diverse student population, with programs like the HOPE and Zell Miller scholarships for Georgia residents.

13. Yale University

Yale’s financial policies are designed to make education affordable, meeting 100% of demonstrated need with a no-loan policy for families with certain incomes.

14. Northeastern University

Northeastern provides a variety of aid, including grants, scholarships, and work opportunities, with a focus on experiential learning programs.

15. University of California, Berkeley (Berkeley)

Berkeley’s financial aid program is robust, offering the Middle Class Access Plan to help middle-income Californian families.

16. Baylor University

Baylor is a private university with a range of financial aid options, including scholarships based on academic achievement, leadership, and community service.

17. Georgia Institute of Technology (Georgia Tech)

Georgia Tech offers financial aid to both in-state and out-of-state students, with a focus on scholarships for STEM majors.

18. Howard University

Howard is a historically black university with a range of financial aid programs designed to support diversity and academic excellence.

19. Northwestern University

Northwestern meets 100% of demonstrated financial need for all admitted students, with grants, scholarships, and work-study options.

20. University of Chicago (UChicago)

UChicago’s financial aid initiatives include the Odyssey Scholarship Program, aimed at eliminating loans for low-income families.

The Trend and Its Implications

The prevalence of these institutions in searches signals a desire for quality education alongside financial feasibility. Students are actively seeking out institutions known for generous aid programs, a reflection of the increasing financial burden of college costs.

Why Partner with a Financial Aid Advisor?

Navigating the financial aid process can be complex and overwhelming.

A financial aid advisor can help you:

- Understand the Different Types of Aid: From grants to work-study programs, understand what’s available and how to apply.

- Maximize Your Aid Package: Learn strategies to increase your eligibility for aid and receive the best possible offer.

- Navigate the Application Process: Get assistance with filling out the FAFSA, CSS Profile, and other necessary documents accurately and on time. Explore Scholarships: Uncover lesser-known scholarships and learn how to craft winning applications.

- Negotiate Aid Offers: Learn the art of financial aid appeal to potentially secure more funding.

Take Action for Your Financial Future

In a sea of rising tuition fees and complex aid packages, a financial aid advisor is your lighthouse. Don’t navigate these waters alone. With professional guidance, you can uncover the full spectrum of financial aid opportunities at these top-searched colleges and universities.

Are you ready to unlock the potential of financial aid? Fill out our Complimentary Consultation Form and start the process to chart the course to your academic and financial success together!

Contact our team of experienced college Financial Aid experts today and increase your chances of receiving the aid you need to make your educational dreams a reality.